Latest News

छोटी SIP से बड़ा रिटर्न या बड़ी SIP से कम समय में अमीरी? रिजल्ट देख दिमाग हिल जाएगा!

क्या आप जानते हैं कि सिर्फ ₹5,000 की SIP से आप करोड़पति बन सकते हैं — वो भी बिना किसी रिस्क के ज्यादा झंझट के? इस लेख में हम आपको बताएंगे कि कैसे एक सामान्य इन्वेस्टर भी कंपाउंडिंग और लॉन्ग टर्म स्ट्रैटेजी से बना सकता है ₹1.5 करोड़ का फंड। पढ़िए पूरी डिटेल्स अंदर

High Court Ruling: पत्नी को पति की पूरी संपत्ति पर हक नहीं है, कोर्ट ने सुनाया फैसला

दिल्ली हाईकोर्ट ने अपने फैसले में स्पष्ट किया कि पति की संपत्ति पर पत्नी का अधिकार वसीयत की शर्तों पर निर्भर करता है। उपयोग का अधिकार स्वामित्व नहीं होता और पत्नी संपत्ति बेच नहीं सकती। इस फैसले ने संपत्ति विवादों को लेकर उत्पन्न भ्रम को काफी हद तक दूर कर दिया है।

Rat Problem? सिर्फ ₹10 में घर से चूहे होंगे गायब! जानिए 3 सबसे सस्ते और असरदार उपाय

चूहों से छुटकारा पाने के लिए जरूरी नहीं कि आप उन्हें मारें। लहसुन, पुदीना और बेकिंग सोड़ा जैसे घरेलू उपायों से आप चूहों को बिना मारे भगा सकते हैं। ये तरीके सस्ते, सुरक्षित और असरदार हैं।

PAN, आधार और पासपोर्ट पर बड़ा अपडेट! दस्तावेजों को लेकर सरकार ने क्या कहा?

भारत सरकार एकीकृत डिजिटल पोर्टल ला रही है जिससे नागरिक अब एक ही जगह से आधार, PAN, वोटर आईडी, पासपोर्ट और ड्राइविंग लाइसेंस जैसे दस्तावेजों में नाम, पता और नंबर बदल सकेंगे। यह पोर्टल सभी बदलावों को एक साथ अपडेट करेगा, जिससे समय और मेहनत दोनों की बचत होगी। यह डिजिटल इंडिया के विज़न को और मजबूत करेगा।

Chanakya Niti: अगर जीवन में हैं ये 3 आदतें, तो पतन तय है, वक्त रहते सुधर गए तो बच सकती है इज्जत

चाणक्य नीति हमें जीवन में आलस्य, लापरवाही और नेतृत्व की कमी जैसे नुकसानों से आगाह करती है। इसमें बताया गया है कि ज्ञान का नाश आलस्य से होता है, धन का नाश जब वह पराए हाथों में होता है, और प्रयास का फल तभी मिलता है जब वह संपूर्ण हो। यह नीति आज के जीवन में भी उतनी ही प्रासंगिक और मार्गदर्शक है।

पति के रहते दूसरी शादी मान्य? हाईकोर्ट ने सुनाया बड़ा फैसला

मध्यप्रदेश हाईकोर्ट ने एक याचिका खारिज करते हुए स्पष्ट किया कि बिना पहले पति से तलाक लिए किया गया दूसरा विवाह अवैध होता है। कुटुंब न्यायालय और हाईकोर्ट दोनों ने याचिकाकर्ता की अपील खारिज की, क्योंकि पहला विवाह कानूनी रूप से समाप्त नहीं हुआ था। इस फैसले से स्पष्ट होता है कि सरकारी सुविधाओं के लिए विवाह का कानूनी रूप से वैध होना आवश्यक है।

Beer के ये फायदे जानकर आप भी कहेंगे, हेल्दी रहने के लिए रोज़ एक बोतल ज़रूरी! लेकिन कितनी मात्रा है सही?

बीयर का सीमित मात्रा में सेवन गर्मियों में शरीर को ठंडक देने के साथ-साथ किडनी स्टोन, दिल की बीमारियों, हड्डियों की कमजोरी और टाइप-2 डायबिटीज जैसी समस्याओं से बचाव में कारगर है। बीयर में पाए जाने वाले एंटीऑक्सिडेंट्स, विटामिन्स और खनिज तत्व स्वास्थ्य को संपूर्ण रूप से लाभ पहुंचाते हैं, लेकिन अधिक सेवन से स्वास्थ्य को खतरा हो सकता है।

Wheat Storage Tips: कई साल तक घर में स्टोर कर सकते हैं गेहूं, कभी नहीं लगेंगे कीड़े, ये हैं सुरक्षित रखने के उपाय

उत्तर प्रदेश के कृषि विभाग के निदेशक डॉ जितेंद्र कुमार तोमर के अनुसार, गेहूं की कटाई के बाद उचित स्टोरेज बेहद जरूरी है। किसान यदि गेहूं को अच्छी तरह सुखाकर साफ ड्रम या बोरियों में सल्फोस गोली के साथ स्टोर करें और नीम-हींग जैसे घरेलू उपायों को अपनाएं, तो वे सालभर अपने अनाज को सुरक्षित रख सकते हैं और फसल की गुणवत्ता बनाए रख सकते हैं।

सिर्फ ₹18,000 में लॉन्च हुआ चादर जैसा Solar Panel! अब दीवार पर लगाकर चलाएं AC, कूलर और पंखा

Flexible Solar Panel एक हल्का, टिकाऊ और पावरफुल सोलर समाधान है जो आपको बिजली के भारी बिल और बार-बार की कटौती से राहत दिला सकता है. इसकी कीमत ₹18,000 से शुरू होकर ₹60,000 तक जाती है और इसे किसी भी सतह पर आसानी से इंस्टॉल किया जा सकता है. AC तक चलाने की क्षमता और 25 साल की वारंटी इसे एक स्मार्ट, लॉन्ग टर्म इनवेस्टमेंट बनाती है.

गर्मी में राहत का तोहफा! बड़ा वॉटर टैंक और इन्वर्टर पर भी चलेगा ये शानदार डेजर्ट एयर कूलर

Thomson Gladiator GD95 एक प्रीमियम डेजर्ट एयर कूलर है जो ₹10,000 से कम कीमत में बेहतरीन कूलिंग, हाई एयर थ्रो, 95 लीटर टैंक और इन्वर्टर कंपैटिबिलिटी के साथ आता है। इसकी मजबूत बिल्ड और थर्मल ओवरलोड प्रोटेक्शन इसे गर्मियों में परफेक्ट कूलिंग सॉल्यूशन बनाते हैं। बड़े कमरों और आउटडोर उपयोग के लिए भी यह उपयुक्त है।

Buri Najar Ke Upay: बुरी नजर का अचूक इलाज! ये टोटके बनेंगे आपके लिए शक्तिशाली कवच, नकारात्मकता नहीं पास फटकेगी

बुरी नजर से उत्पन्न नकारात्मक ऊर्जा स्वास्थ्य और मनोबल को प्रभावित कर सकती है। परंपरागत उपाय जैसे सफेद नमक, जूठी रोटी या काले धागे से नजर उतारना बेहद कारगर माने जाते हैं। यह लेख इन उपायों की विस्तार से व्याख्या करता है और बच्चों व वयस्कों दोनों के लिए अलग-अलग समाधान प्रस्तुत करता है। साथ ही नजर दोष से बचाव के प्रभावी तरीके भी बताए गए हैं।

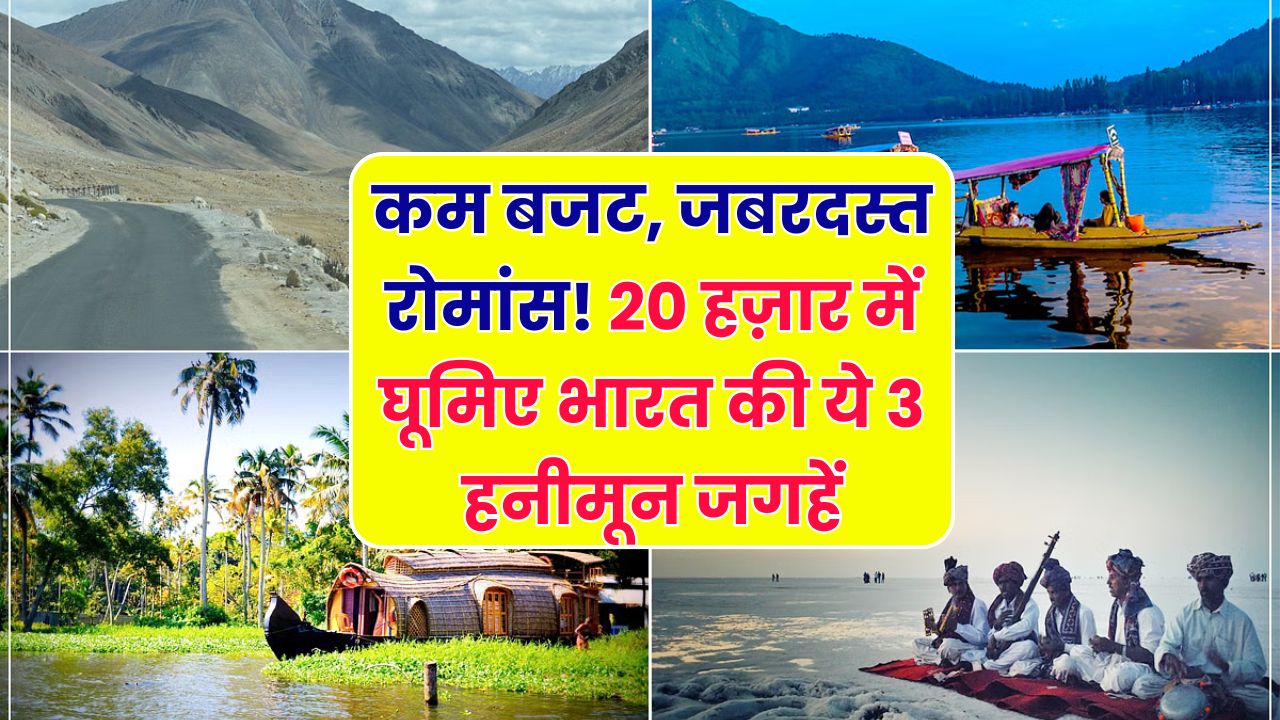

सिर्फ 20 हजार में बनाएं यादगार हनीमून! भारत की ये 3 सस्ती जगहें आपका दिल जीत लेंगी

भारत में कई ऐसी खूबसूरत हनीमून डेस्टिनेशन्स हैं जहां आप ₹20,000 के अंदर एक रोमांटिक और यादगार ट्रिप प्लान कर सकते हैं। शिमला, जयपुर और माउंट आबू जैसे शहर शानदार नजारों और बजट फ्रेंडली सुविधाओं के साथ कपल्स को आकर्षित करते हैं। लोकल ट्रांसपोर्ट, सस्ते होटल्स और स्वादिष्ट खाना इस सफर को और खास बना देते हैं। इस लेख में जानिए सबसे बेहतरीन और सस्ती हनीमून जगहों के बारे में।

NEET UG 2025 में टॉप करना हुआ बेहद मुश्किल! कम नंबर वालों को भी मिल सकती है सरकारी MBBS सीट

NEET UG 2025 का पेपर अब तक का सबसे कठिन माना जा रहा है, जिससे MBBS की सरकारी सीट के लिए कटऑफ में 100 अंक तक की गिरावट की संभावना है। फिजिक्स, केमिस्ट्री और बायोलॉजी तीनों में छात्रों के अंक सामान्य से काफी कम रहे हैं, जिससे औसतन स्कोर 200 अंक तक गिरा है। परिणामों के बाद एडमिशन की स्थिति स्पष्ट होगी।

तहसीलदार बनो या जेल जाओ!’ गरीबों पर बुलडोज़र चलाने वाले अफसर को सुप्रीम कोर्ट की कड़ी फटकार

आंध्र प्रदेश के डिप्टी कलक्टर टाटा मोहन राव को सुप्रीम कोर्ट ने हाई कोर्ट की अवमानना मामले में दो विकल्प दिए हैं—या तो वह नायब तहसीलदार का पद स्वीकार करें या 2 महीने जेल की सजा भुगतें। गरीबों के घर तोड़ने के मामले में अदालत ने कड़ा रुख अपनाया है और साफ किया कि कानून से ऊपर कोई नहीं। अगली सुनवाई 9 मई को निर्धारित है।

रिटायरमेंट से पहले इंक्रीमेंट का विवाद खत्म! हाईकोर्ट के आदेश से हजारों कर्मचारियों खुश

इलाहाबाद हाईकोर्ट के ताज़ा फैसले ने हजारों रिटायर कर्मचारियों के चेहरे पर मुस्कान ला दी है। अगर आप भी 30 जून को रिटायर हो रहे हैं या हाल ही में हुए हैं तो यह खबर आपके लिए है बेहद खास! जानिए कैसे सिर्फ एक दिन के अंतर से मिल सकता है पूरा इंक्रीमेंट का फायदा

60 लाख की Fortuner को भी टक्कर देती है महिंद्रा की ये 7-सीटर SUV! कीमत जान उड़ जाएंगे होश

Mahindra Scorpio N, Toyota Fortuner जैसी प्रीमियम SUV का एक किफायती विकल्प है। यह दमदार इंजन, बेहतरीन फीचर्स, 5-स्टार सेफ्टी और आकर्षक डिज़ाइन के साथ आती है। इसकी कीमत Fortuner के मुकाबले लगभग आधी है, लेकिन सुविधाएं और परफॉर्मेंस के मामले में किसी से कम नहीं।

पेगासस जासूसी केस पर सुप्रीम कोर्ट का बड़ा फैसला! सरकार को दे दी क्लीन चिट

सुप्रीम कोर्ट ने पेगासस जासूसी मामले में तकनीकी पैनल की रिपोर्ट को सार्वजनिक करने से इनकार करते हुए राष्ट्रीय सुरक्षा को सर्वोच्च प्राथमिकता दी। कोर्ट ने कहा कि स्पाइवेयर का उपयोग यदि आतंकियों के खिलाफ हो, तो गलत नहीं, लेकिन नागरिकों की निजता भंग करना गंभीर विषय है। विशेषज्ञ समिति की रिपोर्ट साझा नहीं की जाएगी, पर प्रभावित व्यक्ति जांच की मांग कर सकते हैं। मामला अब 30 जुलाई को फिर सुना जाएगा।

Cooler और Ceiling Fan साथ में चला कर सोते हैं? इस आदत के चौंकाने वाले साइड इफेक्ट्स भी जान लो

गर्मियों में कूलर और पंखा एक साथ चलाने की आदत आम है, लेकिन यह एयर फ्लो को खराब कर देती है और बिजली की खपत बढ़ा देती है। कूलर से पहले ठंडक पैदा करें, फिर पंखे से उसे फैलाएं – यही सही तरीका है। इससे न केवल ठंडक बनी रहेगी, बल्कि बिजली का बिल भी कम आएगा और उपकरण भी लंबे समय तक टिकेंगे।

Aadhaar, PAN या पासपोर्ट? जानिए भारत की नागरिकता का असली सबूत क्या है

भारतीय नागरिकता साबित करने के लिए केवल पहचान पत्र नहीं, बल्कि कानूनी रूप से स्वीकृत दस्तावेज और प्रक्रियाएं आवश्यक होती हैं। आधार, पैन, राशन कार्ड नागरिकता सिद्ध नहीं करते, जबकि पासपोर्ट इसे प्रमाणित करता है। भारतीय नागरिकता का निर्धारण Indian Citizenship Act, 1955 के तहत होता है। इस लेख में बताया गया है कि किन दस्तावेजों से आप भारतीय नागरिकता को प्रमाणित कर सकते हैं।

Liquor Shops Closed: मदिरा प्रेमियों के लिए जरूरी खबर, 12 मई को नहीं मिलेगी शराब बंद रहेंगे सभी ठेके

बुद्ध पूर्णिमा के अवसर पर रायपुर नगर निगम ने 12 मई 2025 को नगर क्षेत्र में मांस-मटन विक्रय पर पूर्ण प्रतिबंध लगाया है। महापौर मीनल चौबे के निर्देश पर जारी आदेश का उल्लंघन करने पर कानूनी कार्रवाई होगी। यह निर्णय धार्मिक सौहार्द को बनाए रखने हेतु लिया गया है और निगम अधिकारी इसका सख्ती से पालन सुनिश्चित करेंगे।

दवा असली है या नकली दवाओं की पहचान कैसे करें, ये ट्रिक बताएगी दवा असली है या नकली 2 सेकंड में

CDSCO की रिपोर्ट में सामने आया है कि 53 प्रमुख दवाएं लैब टेस्ट में फेल हुई हैं, जो नामी कंपनियों के लेबल में थीं। इनमें पैरासिटामोल, डिक्लोफेनेक, फ्लुकोनाजोल और विटामिन D जैसी जरूरी दवाएं शामिल हैं। भारत में करीब 25% दवाएं नकली पाई जाती हैं। नकली दवाओं की पहचान के लिए QR कोड स्कैनिंग, पैकेजिंग की जांच और लेबल में त्रुटियों की पहचान करना जरूरी है।

Lucky Moles On Female Body: लड़की के शरीर पर किस तिल का क्या मतलब होता है? कौन सा तिल भाग्यशाली देखें

महिलाओं के शरीर पर तिल न केवल त्वचा की सजावट होते हैं बल्कि समुंदरशास्त्र के अनुसार यह जीवन के संकेत भी देते हैं। माथे, पीठ, होंठ, गाल, कंधे, गर्दन जैसे स्थानों पर तिल शुभ माने जाते हैं जो भाग्य, समृद्धि और आकर्षण का प्रतीक हैं। इन तिलों से महिलाओं के स्वभाव और जीवन की दिशा के बारे में काफी कुछ जाना जा सकता है।

ज़मीन रजिस्ट्री का सिस्टम बदल गया! अब 500 में होगी रजिस्ट्री और आधार से लिंक होगी प्रॉपर्टी

छत्तीसगढ़ में अब जमीन रजिस्ट्री पहले से कहीं ज्यादा सरल और डिजिटल हो गई है। पंजीयन विभाग ने नियमों में 10 बदलाव करते हुए आधार लिंकिंग, ऑनलाइन दस्तावेज, डिजी-लॉकर और घर बैठे रजिस्ट्री जैसी आधुनिक सुविधाएं जोड़ी हैं। मंत्री ओपी चौधरी ने इसकी जानकारी दी और अफसरों को जनजागरूकता बढ़ाने के निर्देश दिए। साथ ही अर्जेंट मामलों में शुल्क घटाकर सिर्फ 500 रुपये कर दिया गया है।

Operation Sindoor से तिलमिलाया पाकिस्तान! नरेंद्र मोदी स्टेडियम को उड़ाने की धमकी, IPL के इतने मैच खतरे में

भारतीय सेना द्वारा 6-7 मई को किए गए ऑपरेशन सिंदूर में 26 आतंकवादियों को मार गिराया गया। इस कार्यवाही के तुरंत बाद गुजरात क्रिकेट एसोसिएशन को नरेंद्र मोदी स्टेडियम को बम से उड़ाने की धमकी मिली। सुरक्षा एजेंसियों ने तत्परता से कार्य करते हुए स्टेडियम की जांच की और सुरक्षा बढ़ा दी गई। आगामी आईपीएल मुकाबलों के चलते खतरे को गंभीरता से लिया जा रहा है।

ऑपरेशन सिंदूर के बाद देश में अलर्ट! मॉक ड्रिल के दौरान भूलकर भी न करें ये गलतियां, जानें क्या है सही तरीका

भारत ने 'ऑपरेशन सिंदूर' के तहत पाकिस्तान में 9 आतंकी ठिकानों को किया ध्वस्त, अब देशभर में अलर्ट – मॉक ड्रिल की अहमियत पहले से कहीं ज्यादा बढ़ गई है, भारत ने पाकिस्तान में किए 9 आतंकी ठिकानों पर प्रहार, देशभर में रेड अलर्ट और मॉक ड्रिल का दौर शुरू! क्या आप जानते हैं कि मॉक ड्रिल के दौरान आपकी एक गलती कितनी बड़ी आफत ला सकती है? जानिए क्या करें और क्या नहीं – ताकि संकट में आप और देश दोनों रहें सुरक्षित।

Operation Sindoor: भारतीय सेना का करारा वार, इन अधिकारियों और जवानों ने मिलकर पूरा किया मिशन

तीनों सेनाओं की संयुक्त कार्रवाई में पाकिस्तान व POK के 9 आतंकी ठिकानों को बनाया गया निशाना, ऑपरेशन सिंदूर को भारत ने पहलगाम हमले का लिया बदला – ऑपरेशन सिंदूर के तहत 9 आतंकी अड्डे खत्म।भारतीय सेना, वायुसेना और नौसेना का संयुक्त हमला! जानिए किन अधिकारियों और जवानों ने रचा यह इतिहास, और कैसे दिया गया आतंकवाद को करारा जवाब।

स्कूल की 46 दिन की छुट्टियाँ शुरू! अब सीधा इस तारीख को खुलेंगे सरकारी और प्राइवेट स्कूल

School Holiday 2025 में 1 मई से 15 जून तक छात्रों को कुल 46 दिन की गर्मी की छुट्टियां मिलेंगी। यह फैसला बढ़ती गर्मी और बच्चों की सुरक्षा को ध्यान में रखते हुए लिया गया है। सभी सरकारी और प्राइवेट स्कूलों पर समान नियम लागू होंगे। इस दौरान बच्चों के लिए ऑनलाइन समर क्लासेस, स्वास्थ्य सुझाव और विकासात्मक गतिविधियां भी उपलब्ध रहेंगी, जो इन छुट्टियों को रचनात्मक और उपयोगी बनाएंगी।

Rajasthan Blackout Alert: आज रात इन शहरों में इस वक्त होगा ब्लैक आउट! जानिए कब और कहां होगा बिजली गुल

ऑपरेशन सिंदूर की सफलता के बाद राजस्थान के छह शहरों में आज रात ब्लैक आउट ड्रिल की जाएगी। यह अभ्यास नागरिकों की सुरक्षा तैयारियों को परखने के लिए है, जिसमें सायरन बजते ही सभी लाइटें बंद करनी होंगी। प्रशासन ने लोगों से जागरूक और जिम्मेदार सहभागिता की अपील की है। इस योजना का उद्देश्य आपदा प्रबंधन के प्रति लोगों को प्रशिक्षित और सजग बनाना है।

Bank Loot: बैंक ऑफ महाराष्ट्र में दिनदहाड़े डकैती! 5 करोड़ का सोना और ₹15 लाख लेकर फरार हुए लुटेरे

समस्तीपुर, बिहार में बैंक ऑफ महाराष्ट्र की एक शाखा में अपराधियों ने हथियार के बल पर 5 करोड़ का सोना और 15 लाख कैश लूट लिया। लुटेरे ग्राहक बनकर बैंक में घुसे और सभी को बंधक बनाकर वारदात को अंजाम दिया। पुलिस जांच में जुटी है, लेकिन अपराधियों का कोई सुराग अभी तक नहीं मिला है। यह घटना राज्य की सुरक्षा व्यवस्था पर गंभीर सवाल खड़े करती है।

Home Remedies for Hair: सिर्फ 1 महीने में बाल होंगे लंबे, घने और मजबूत, अपनाएं ये 6 देसी नुस्खे

प्राकृतिक उपायों जैसे प्याज का रस, मेथी, एलोवेरा और दही से बालों की ग्रोथ तेज होती है और वे जड़ों से मजबूत बनते हैं। ये घरेलू नुस्खे सस्ते, सुरक्षित और प्रभावी हैं। सही खानपान और नियमित देखभाल के साथ इनका उपयोग कर आप बालों को लंबा, घना और चमकदार बना सकते हैं, वो भी बिना महंगे ट्रीटमेंट के।

अब बिना हेलमेट अब नहीं मिलेगा पेट्रोल! लागू हुआ नया नियम

गौतमबुद्ध नगर में सड़क सुरक्षा को लेकर बड़ा फैसला—अब बिना हेलमेट दोपहिया वाहन चालकों को पेट्रोल नहीं मिलेगा और बिना सीट बेल्ट के नहीं मिलेगा किसी भी सरकारी या निजी दफ्तर में प्रवेश! स्कूल बसों पर भी आई सख्ती और गांव-गांव चलेगा ट्रैफिक अवेयरनेस कैंपेन। जानिए कौन-कौन आएगा इस सख्ती की जद में

हरियाणा में शराब होगी और महंगी! नई एक्साइज पॉलिसी से देसी से लेकर बीयर तक सब पर पड़ेगा असर

हरियाणा सरकार की नई आबकारी नीति 2025-27 के तहत शराब के दामों में बढ़ोतरी, हाईवे पर ठेकों पर रोक और छोटे गांवों में ठेकों का बंद होना जैसे सख्त प्रावधान किए गए हैं। साथ ही, आहतों के लिए नए नियम और फीस ढांचे से शराब बिक्री व्यवस्था को अधिक संयमित और नियंत्रित बनाने का प्रयास किया गया है। यह नीति 12 जून 2025 से प्रभावी होगी।

CISCE ISC ICSE Result 2025: आज 11 बजे आएगा 10वीं-12वीं का रिजल्ट! results.cisce.org पर करें सबसे पहले चेक

ICSE और ISC बोर्ड परीक्षा 2025 का रिजल्ट आज होगा जारी, जानिए कहां और कैसे करें रिजल्ट चेक, स्कॉलरशिप और री-चेकिंग की जानकारी भी सिर्फ यहीं! पढ़ें पूरी डिटेल्स आगे…

JAC Board Result 2025: झारखंड बोर्ड 10वीं-12वीं का रिजल्ट जल्द, जानिए कब और कैसे होगा जारी

झारखंड बोर्ड 10वीं-12वीं का रिजल्ट बस कुछ ही दिनों में! रिजल्ट की आधिकारिक तारीख का इंतजार, 10 मई तक जारी होने की संभावना, SMS से लेकर वेबसाइट तक जानें चेक करने का पूरा प्रोसेस, वेबसाइट से लेकर SMS तक, जानिए कैसे चेक करें रिजल्ट, कब मिलेगी मार्कशीट, और कैसे पाएं अपडेट सबसे पहले!

Gold Storage Rules in India: घर में कितना सोना रखना है लीगल? नियम जानिए वरना पड़ सकते हैं मुसीबत में

भारत में सोना सिर्फ आभूषण नहीं, एक भावनात्मक और निवेश का प्रतीक है। लेकिन इसके साथ जुड़े Gold Storage Rule, टैक्स नियम और बाजार दरों की जानकारी होना हर व्यक्ति के लिए जरूरी है। सही जानकारी और दस्तावेज़ों के साथ आप सुरक्षित रूप से घर में सोना रख सकते हैं।

CGBSE Result 2025: छत्तीसगढ़ बोर्ड 10वीं-12वीं के टॉपर्स घोषित, जानें किसने मारी बाज़ी

छत्तीसगढ़ बोर्ड ने घोषित किया 10वीं-12वीं का रिजल्ट! 99.17% के साथ इशिका बाला बनीं टॉपर, 12वीं में अखिल सेन ने मारी बाज़ी। जानिए किन छात्रों ने टॉप 10 में बनाई जगह, कहां से हैं ये मेधावी और अब आगे क्या? देखिए टॉपर्स की पूरी सूची और मार्क्स के साथ CGBSE रिजल्ट की हर डिटेल। यहां देखें पूरी टॉपर्स लिस्ट

भारत-पाकिस्तान जंग में बदल सकता है वर्ल्ड वॉर? क्या बढ़ते हालात दे रहे हैं तीसरे विश्व युद्ध की दस्तक?

ऑपरेशन सिंदूर के बाद सीमा पर हालात बेहद तनावपूर्ण, परमाणु ताकत से लैस दोनों देश आमने-सामने, क्या वैश्विक टकराव की जमीन तैयार हो रही है? ऑपरेशन सिंदूर के बाद भारत-पाकिस्तान आमने-सामने, सीमा पर बढ़ती गोलीबारी और बयानबाज़ी से तनाव चरम पर है! दोनों देशों के पास हैं परमाणु हथियार – क्या यह संघर्ष खींच लेगा दुनिया को तीसरे विश्व युद्ध की ओर? जानिए क्या कहते हैं रक्षा विशेषज्ञ और अंतरराष्ट्रीय कूटनीतिक सूत्र।

मध्यप्रदेश के किसानों के लिए बड़ी खुशखबरी! अब आधे दाम में मिलेगा ट्रैक्टर और पावर ट्रिलर

मध्य प्रदेश सरकार की ई-कृषि यंत्र अनुदान योजना किसानों को 50% तक सब्सिडी के साथ छोटे ट्रैक्टर और उन्नत कृषि यंत्र प्रदान कर रही है। इसका उद्देश्य खेती को कम खर्चीला, अधिक उत्पादक और पर्यावरण के अनुकूल बनाना है। लॉटरी के ज़रिए चयनित किसानों को यह लाभ मिलेगा। यह योजना प्रदेश में खेती की दिशा बदलने का सामर्थ्य रखती है।

Online Payment बंद! 10 मई से पेट्रोल-डीजल सिर्फ कैश में मिलेगा, क्या है पूरा मामला

नागपुर में 10 मई 2025 से पेट्रोल पंपों पर डिजिटल पेमेंट पूरी तरह बंद किया जा रहा है. साइबर फ्रॉड के बढ़ते मामलों के चलते यह निर्णय लिया गया है. अब पेट्रोल केवल नकद भुगतान से ही मिलेगा. डीलरों ने यह कदम अपनी सुरक्षा के लिए उठाया है और फिलहाल इसके स्थगित होने की कोई संभावना नहीं है. नागरिकों को सलाह है कि कैश साथ लेकर ही पेट्रोल पंप जाएं.

अब दिल्ली की पुरानी DTC बसों में मिलेगा फूड का मजा! सरकार का जबरदस्त प्लान

दिल्ली सरकार ने पुरानी DTC बसों को फूड किओस्क में बदलने की पहल की है। साथ ही आनंद विहार और सराय काले खां ISBT को मल्टी-मॉडल ट्रांजिट हब में बदला जा रहा है। हीट एक्शन प्लान-2025 के तहत यात्रियों के लिए डिजिटल वाटर कूलर, ‘जल दूत’ और जागरूकता अभियान भी चलाए जा रहे हैं। यह योजना दिल्ली को एक स्मार्ट और सुविधाजनक शहर बनाएगी।

Insurance Policy Rules: इंश्योरेंस पॉलिसी में जल्द बदल जाएंगे नियम! पूरा सिस्टम बदल जाएगा, जान लें नियम

IRDAI ने बीमा बिक्री में पारदर्शिता लाने के लिए एक नया प्रस्ताव तैयार किया है, जिसके तहत बैंक अब बीमा कंपनियों से कमीशन नहीं लेंगे। ग्राहक से मार्केट आधारित ट्रांजेक्शन फीस वसूल कर, बीमा कंपनियों को केवल प्रीमियम दिया जाएगा। यह कदम बीमा को सस्ता, प्रतिस्पर्धी और उपभोक्ता हितैषी बनाएगा, साथ ही 2047 तक ‘सबके लिए बीमा’ लक्ष्य को साकार करने की दिशा में अग्रसर करेगा।

मोबाइल Addiction से बढ़ रही है ‘Text Neck’ बीमारी! अब नहीं संभले तो पछताना पड़ेगा

स्मार्टफोन और लैपटॉप के अत्यधिक उपयोग से टेक्स्ट नेक सिंड्रोम जैसी समस्या बढ़ रही है, जिससे गर्दन, कंधे और रीढ़ की हड्डी पर गंभीर असर पड़ता है। सही जानकारी और सावधानी से इससे बचा जा सकता है।

पासपोर्ट या वोटर ID नहीं? ऐसे साबित करें कि आप भारतीय हैं – नागरिकता के लिए सरकार का नया नियम!

दिल्ली पुलिस के आदेश के बाद बढ़ी चर्चा, जानिए किन दस्तावेजों को माना जा सकता है नागरिकता का वैध प्रमाण, सरकार ने कहा– आधार, पैन और राशन कार्ड से नहीं मानेगी नागरिकता! अगर आपके पास पासपोर्ट या वोटर कार्ड नहीं है तो घबराएं नहीं। जानिए कौन से दस्तावेज से अब आप भारतीय साबित कर सकते हैं। पूरी जानकारी जो हर नागरिक को जाननी चाहिए, वरना फंस सकते हैं बड़ी मुसीबत में

Can Soldiers Refuse To Fight: क्या सेना के जवान जंग लड़ने से मना कर सकते हैं? जानें क्या है फौज में इसके नियम

भारत-पाक तनाव के बीच यह जानना जरूरी है कि भारतीय सैनिक युद्ध से इनकार नहीं कर सकते। वे राष्ट्र की रक्षा की शपथ लेते हैं और उनका अनुशासन उन्हें युद्ध के लिए बाध्य करता है। कुछ अपवाद—जैसे बीमारी—छूट प्रदान कर सकते हैं, लेकिन व्यक्तिगत इनकार की अनुमति नहीं होती। विवेक आधारित आपत्ति की धारणा भारत में सीमित और दुर्लभ है।

Summer Vacation 2025: यूपी, एमपी, बिहार और राजस्थान में देखें छुट्टियों की पूरी लिस्ट

गर्मी की लहर ने स्कूलों में समर वेकेशन की तारीखों को प्रभावित किया है। दिल्ली-एनसीआर, उत्तर प्रदेश, बिहार, मध्य प्रदेश और राजस्थान में छुट्टियां जल्द ही शुरू होने वाली हैं। जानें, किस राज्य में कब से शुरू हो रही हैं समर वेकेशन और क्या है इसका कारण।

CGBSE Result 2025 जारी, छत्तीसगढ़ 10वीं-12वीं के नतीजे, यहां देखें डायरेक्ट लिंक और चेक करने का आसान तरीका

5.71 लाख छात्रों का इंतजार खत्म! छत्तीसगढ़ बोर्ड रिजल्ट आज दोपहर 3 बजे मुख्यमंत्री की प्रेस कॉन्फ्रेंस में होंगे जारी। जानिए Aajtak.in और आधिकारिक वेबसाइट्स पर रोल नंबर से कैसे मिनटों में चेक करें अपना रिजल्ट, कब मिलेगी मार्कशीट और क्या है टॉपर्स की पूरी लिस्ट? पूरी जानकारी एक क्लिक में।

2 दिन काम, 5 दिन आराम! क्या आ रहा है ऐसा सपना सच करने वाला कानून? जानिए कब तक

AI और ऑटोमेशन के बढ़ते प्रभाव से Two-Day Work Week अब एक संभावित हकीकत बनता जा रहा है। बिल गेट्स के विज़न के अनुसार, आने वाले वर्षों में इंसानों को केवल कुछ ही दिन काम करना पड़ेगा क्योंकि मशीनें बाकी काम संभाल लेंगी। दुनिया के कई देशों में यह बदलाव पहले ही शुरू हो चुका है, और भारत भी जल्द इसकी दिशा में सोच सकता है।

भीषण गर्मी के चलते 25 अप्रैल से बंद होंगे स्कूल! 15 जून तक रहेगी लंबी छुट्टी, जानिए पूरा आदेश

छत्तीसगढ़ में बढ़ती गर्मी और लू को देखते हुए राज्य सरकार ने छात्रों के लिए 25 अप्रैल से 15 जून तक ग्रीष्मकालीन अवकाश की घोषणा की है। इस कदम से बच्चों को गर्मी और डिहाइड्रेशन से बचाया जाएगा, जबकि शिक्षकों के लिए पुराने निर्देशों में कोई बदलाव नहीं किया गया है। यह निर्णय बच्चों की सुरक्षा और स्वास्थ्य के मद्देनजर लिया गया है।

गर्मी में AC चलाते वक्त की ये छोटी गलतियां बना सकती हैं उसे बम! जानिए कैसे बचें हादसे से

गर्मी के मौसम में AC का सुरक्षित उपयोग बेहद जरूरी है, वरना छोटी सी लापरवाही बड़े हादसे का कारण बन सकती है। सही टेम्परेचर सेटिंग, नियमित सर्विसिंग, और खराब वायरिंग से बचाव जैसे उपाय अपनाकर आप अपने AC को सुरक्षित रख सकते हैं। इस लेख में AC ब्लास्ट के कारणों और बचाव के उपायों पर विस्तार से चर्चा की गई है।

Toll Tax: टोल टैक्स नहीं देना चाहते? इन लोगों को मिलती है छूट, यहां देखें पूरी लिस्ट

भारत में Toll Tax Rules के अंतर्गत कई विशिष्ट व्यक्तियों, अधिकारियों, सेवाओं और विशेष वाहनों को टोल टैक्स से छूट दी जाती है। ये छूट संवैधानिक पद, आपातकालीन सेवाएं, ड्यूटी पर मौजूद अधिकारी, विकलांगों के वाहन और राजकीय विदेशी मेहमानों के लिए मान्य होती हैं। हालांकि, इन छूटों के लिए प्रमाण पत्र और ड्यूटी की पुष्टि आवश्यक है।